Finding a rental apartment in Miami can be challenging, especially if you have a low credit score. Many landlords and property managers check credit reports to assess the financial reliability of potential tenants. However, bad credit doesn’t mean you’re out of options. With the right approach, you can still secure a rental in Miami. This guide explores effective strategies, alternative solutions, and practical tips to increase your chances of approval.

1. Understanding the Role of Credit in Renting

Most Miami landlords use credit scores to evaluate financial responsibility. A score below 600 may raise red flags, while above 700 is generally considered favorable. However, credit isn’t the only factor; income, rental history, and references also play a role in the approval process.

What Landlords Look for in Credit Reports:

✔ Payment history: Late payments, defaults, or collections

✔ Debt-to-income ratio: High outstanding debt vs. income

✔ Rental history: Prior evictions or unpaid rent

✔ Bankruptcies and judgments: Financial difficulties in the past

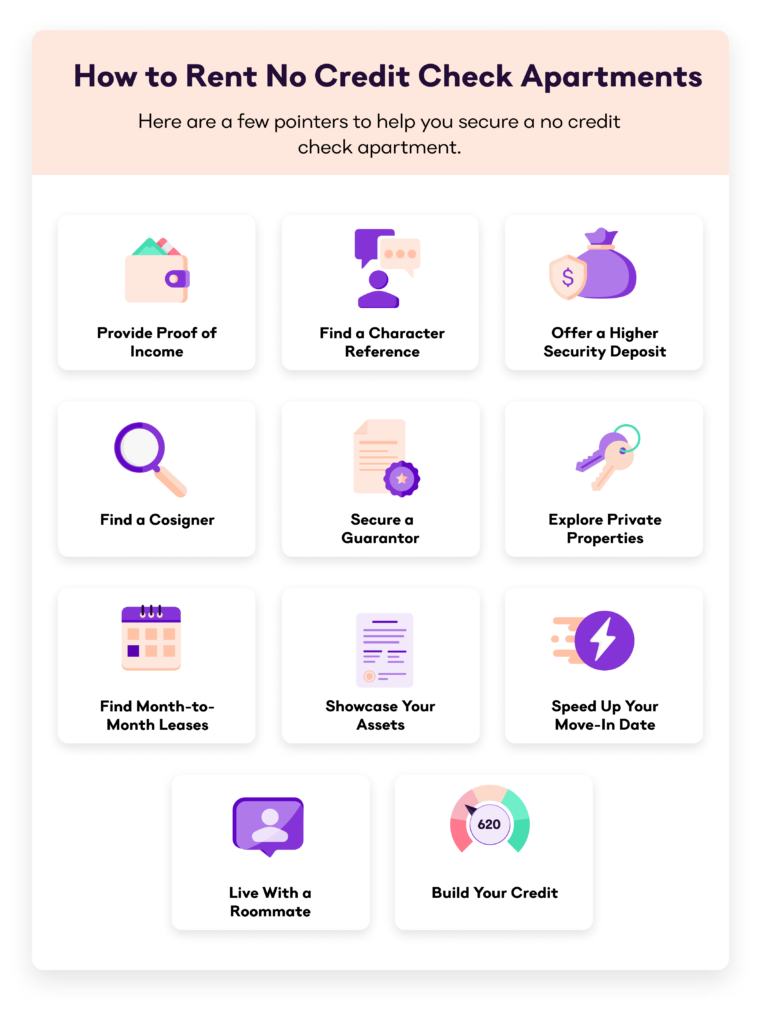

2. Strategies to Secure an Apartment with Bad Credit

1. Provide Proof of Stable Income

Many landlords prioritize reliable income over credit scores. To prove financial stability:

- Show pay stubs, tax returns, or bank statements covering the last 3–6 months.

- Your income should be at least 3x the rent to reassure the landlord of affordability.

2. Offer a Higher Security Deposit

If allowed by Florida law, offering two to three months’ rent upfront can reduce a landlord’s risk and increase approval chances.

3. Get a Co-Signer or Guarantor

A co-signer with strong credit can legally guarantee rent payments, making landlords more likely to accept your application. Be sure the co-signer understands their responsibility.

4. Provide Strong Rental References

A history of timely rent payments can outweigh credit concerns. Ask previous landlords or property managers for reference letters confirming:

✔ On-time payments

✔ Responsible tenant behavior

✔ Good property maintenance

5. Seek Private Landlords Instead of Large Property Management Companies

Corporate apartment complexes have strict credit policies, whereas private landlords may be more flexible and willing to negotiate based on income and references.

6. Show Proof of Responsible Financial Behavior

If your low credit score is due to past mistakes but you’ve improved financially, provide:

✔ Proof of paid-off debts

✔ Recent credit report improvements

✔ Explanation letter detailing past financial hardship and recovery

3. Best Alternative Rental Options for Bad Credit

If traditional rentals deny your application due to low credit, consider these alternatives:

1. Subletting or Renting a Room

- Platforms like SpareRoom, Craigslist, and Facebook Marketplace offer room rentals or sublets, which often don’t require credit checks.

2. No-Credit-Check Apartments

Some landlords skip credit checks but require higher deposits or higher rent. Look for ads that specify “no credit check required” or contact local property owners.

3. Rent-to-Own Options

A rent-to-own agreement allows tenants to rent with an option to buy later, often bypassing strict credit requirements.

4. Extended-Stay Hotels or Corporate Housing

Short-term furnished apartments or extended-stay hotels offer flexible leases without credit checks, giving you time to rebuild your credit.

4. How to Improve Your Credit for Future Rentals

Even if you secure a rental now, improving your credit will make future applications easier. Follow these steps:

✔ Pay Bills on Time – Consistent payments boost your credit score.

✔ Reduce Outstanding Debt – Lower credit card balances and avoid new debt.

✔ Check Your Credit Report for Errors – Dispute incorrect negative items with credit bureaus.

✔ Use Rent Reporting Services – Some services like RentTrack or Experian RentBureau report your rent payments to improve your credit score.

5. Miami Landlords Who Are Flexible on Credit

Here are some rental property types that may work with tenants who have bad credit:

1. Small Landlords & Private Owners

- More likely to accept bad credit if you show financial stability.

- Willing to negotiate higher deposits or short-term leases.

2. Co-Living Spaces

- Shared apartments that focus on community living with flexible lease terms.

- Examples: Common, PadSplit, and Bungalow.

3. Income-Based Housing Options

- HUD & Section 8 Housing: Some Miami housing programs cater to low-income residents.

- Nonprofit housing organizations can assist with placement.

6. What to Avoid When Renting with Bad Credit

🚫 Avoid landlords who demand excessive upfront payments without a written lease.

🚫 Beware of rental scams that promise “no credit check” but require large deposits.

🚫 Don’t sign a lease without reading credit policies – Some landlords impose high late fees or early eviction clauses for tenants with low credit.

7. Final Tips for Renting an Apartment in Miami with Bad Credit

✔ Be Honest About Your Credit Situation: Some landlords may appreciate transparency and willingness to improve.

✔ Consider Roommates: Splitting rent with roommates who have better credit can help secure approval.

✔ Negotiate Lease Terms: Offer shorter lease durations (6-month leases) to prove reliability before committing long-term.

✔ Look for Move-in Specials: Some apartments offer discounts for tenants who pay upfront.

✔ Improve Your Score While Renting: Use secured credit cards, pay off small debts, and maintain financial responsibility.

Having bad credit doesn’t mean you can’t rent an apartment in Miami. By offering financial proof, negotiating terms, and considering alternative rental options, you can secure a great rental even with a low credit score.

Looking for bad-credit-friendly rentals in Miami? Browse our listings and find the right home for you today!

Worried about renting in Miami with bad credit? Learn the best strategies, alternative options, and landlord negotiation tips to secure an apartment despite a low credit score.

MiamiRentals #BadCreditRenting #ApartmentSearch #MiamiHousing #TenantTips #ImproveCredit #RentalApproval #CreditScore #HousingSolutions #RentingWithBadCredit

i moved to Miami 5 days ago from colorado